Track and manage your business expenses so you can make the best strategic decisions for your company with this business budget template. Gain visibility into where you’re overspending, where you need to cutback, and the general health of your company.

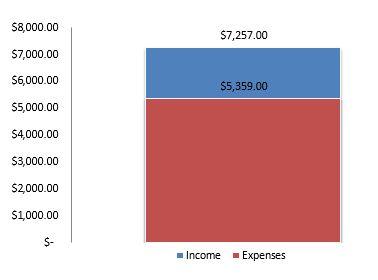

View your budget and expenses in real time so you can make the most informed decisions, track income against expense, and ensure no item goes unseen in savings, spending, or debt repayment goals.

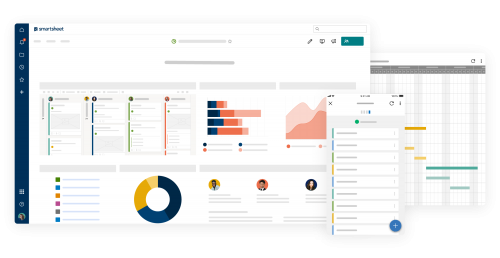

A simple, best practice approach for managing the work, budget, and timeline required to initiate, plan, and launch your project. Share with your team to optimize efficiency, gain consistency, and adopt a data-driven process for any project based work. This Smartsheet solution template includes a task tracker sheet, status report, and project dashboard.

Estimate your department expenses for the upcoming fiscal year, track spend against savings, and compare year-over-year budget numbers by percent changes with this template designed for teams and departments.

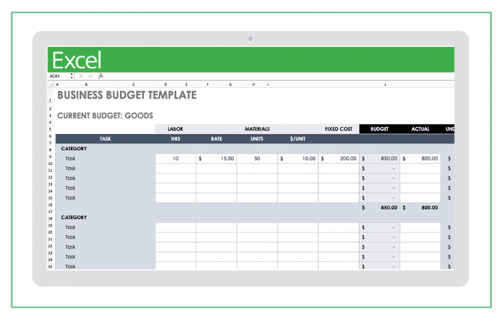

Using this template will help you stay on top of your project budget. Track the material, labor, and fixed costs associated with each project task, and monitor the variance between your actual and budgeted amounts.

Keep an eye on all construction-related expenses, including remodeling, planned improvements, emergency repairs, and labor and material budgets, and monitor the running balance.

This set of templates in Smartsheet helps track monthly actuals against budget goals so you can tightly manage your financial performance and ensure your business stay on track.

List your income and expenses, calculate spend and savings totals, and view which portion of income is going to which category of expenses to stay on top of your budget and ensure you don’t go over.

Document, track, and manage your personal income, expenses, and savings to ensure you’re moving towards your financial goals. Improve visibility into how well you save your money so you can reach your goals faster.

Track, manage, and organize expenses for an entire household on a month-to-month basis, create line items for recurring expenses, and boost savings so you can reach your financial goals faster.

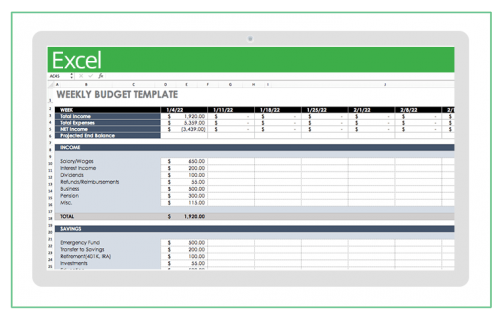

Track your income and expenses on a weekly or bi-weekly basis to gain better insight into where you’re spending the most money and identify areas where you can save. Add additional columns and update your spending goals as time goes on.

Track expenses and manage your budget in one location with this money manager template. With a yearly budget, a monthly budget report, and a transaction history log, you will have one comprehensive budgeting solution in one location to track expenses and income appropriately.

Allocate every dollar of your income to a piece of your budget to better track where your money is going and ensure the difference between your monthly income and expenses equal zero. Document both incoming money and outgoing expenses and adjust allocations accordingly.

Manage your budget every paycheck and ensure you’re allocating every dollar of income toward an outgo, resulting in a zero balance. Reduce the possibility of overspending by tracking transactions and assessing incoming and outgoing money on a regular basis.

Create a budget to help you save money, balance expenses, and manage student loan payments while you’re in college. Track all income and expenses on a quarterly basis and estimate monthly college expense totals to ensure you are always on top of your money.

Track fundraising efforts, document sponsorship amounts, and manage expenses to ensure the operations and strategies of your academic club run smoothly with this comprehensive template. Gain insight into budget versus actual balances and better manage club revenue.

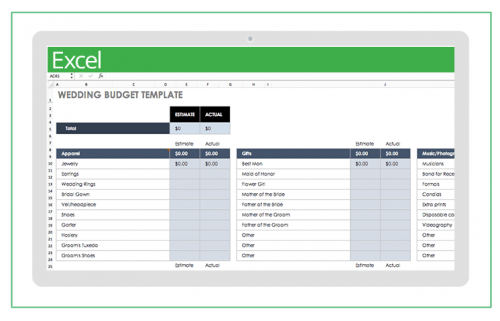

Plan how much money you need to save for your wedding, surface all applicable expenses, estimate overall costs, and establish a baseline spend goal. As you start planning, track actual spend amounts to determine the variance to budget to ensure you remain within the bounds of your ideal spending goal.

Ensure that you’re saving enough money to live comfortably in retirement by creating a comprehensive plan, estimating your daily needs and expenses, and documenting how you will allocate your income. Gain insight into your income and expenses and estimate your budget with inflation factored in to make sure you’re covering all your bases.

To prepare for the holidays, list all gifts to purchase for whom, document how much each will cost, and compare that against a monthly or yearly budget to ensure you have visibility into how much money you are spending during the hectic holiday months.

Finding the right template can help you get started planning your budget, but you should also look for a solution to ensure your finance operations are as efficient as possible. Consider a tool that provides one location for your team to track and manage financial details, from anywhere, in real time.

Smartsheet is an enterprise work execution platform that is fundamentally changing the way businesses and teams work. Use Smartsheet to boost visibility into your finance operations. Make real-time updates and share details with key stakeholders to increase transparency and accountability. Ensure that everyone is working with the most up-to-date information, so that no detail is missed and you are able to make the right decisions at the right time.

Creating a personal budget is not only important for your financial well-being and peace-of-mind, but also for your short and long-term goals. Taking control of your finances with a personal budget template will help you make headway on these goals.

To get started, you want to consider the following steps to help you establish your personal budget:

Now that you’ve made a list of your goals and started tracking your expenses, you can begin creating your actual budget using a personal budget template.

Begin by downloading the personal budget template, and inputting your income, savings goals, and expense amounts for the first month. This template is made up of two sheets, one for your budget breakdown and the second is your dashboard.

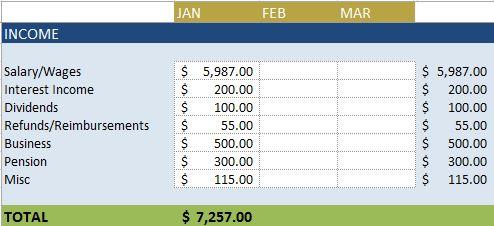

Within the first sheet, you will find three sections, including income, savings and expenses. The categories of the income section are:

The next section is where you will input your savings goals. These goals may include both your short-term and long-term savings goals that you listed earlier. This section includes the following categories, but can be changed to fit your goals:

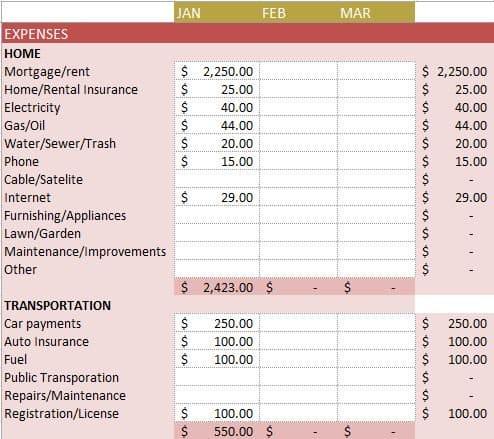

The last section of the personal budget sheet is for expenses. This section has various primary categories, with multiple sub-categories associated. The primary expense categories include:

Once you have input the individual amounts for each of the income, savings, and expense categories, you will see that the total for each month is calculated at the bottom of each column. Additionally, totals are calculated at the end of each row, representing your year-to-date total for each budget item, category and section.

On the second sheet you will find your budget dashboards. Dashboards are helpful to provide a quick visual into the summary and health of your budget, and will automatically update as you make changes to your personal budget sheet. The dashboard sheet included in this personal budget template has the following four distributions: